Relying on population density and fixed-radius circles to define territories is a direct path to failed locations and revenue cannibalization.

- Real-world performance is driven by consumer behavior and accessibility, not simple demographics.

- Mobility intelligence and isochronous mapping provide a realistic model of a territory’s potential.

Recommendation: Shift from static geographic assumptions to dynamic, behavior-based analysis to accurately forecast a catchment area’s true yield.

For any development manager, a failed location is the ultimate nightmare. Millions are invested based on a projection, only to see the unit underperform, drain resources, and tarnish the brand. The root cause is often a flawed understanding of the territory’s real potential. For decades, the standard approach has been to rely on gut feeling, rudimentary demographic overlays, and the deceptively simple fixed-radius circle. This involves drawing a 3-mile or 5-mile ring around a potential site and counting the population within it.

This methodology is fundamentally broken. It assumes a perfectly flat, uniform world where people travel as the crow flies, ignoring rivers, highways, traffic patterns, and, most importantly, human behavior. While looking at population density or basic drive times seems like a step up, these metrics are often just as misleading. They describe who is physically present, but not who is willing to travel, where they come from, or how much they are willing to spend. True territory definition requires a paradigm shift from static geography to dynamic data science.

The key isn’t to ask “how many people live here?” but rather “how does this specific population behave within this specific geographic context?” This is where geospatial data science offers a profound advantage. By analyzing granular mobility intelligence, we can move beyond assumptions and model the complex interplay of accessibility, competition, and consumer choice. This allows us to define catchment areas not as simple circles, but as complex, living polygons that reflect actual customer journeys and forecast a territory’s true financial yield.

This guide will deconstruct the old methods and provide a data-driven framework for carving out profitable, defensible, and sustainable territories. We will explore the precise techniques to model real-world accessibility, quantify cannibalization risk, and identify saturation signals before you commit a single dollar to a new site.

To navigate this complex topic, we have structured the analysis into a series of critical questions every development manager must answer. The following sections provide a clear roadmap from foundational concepts to advanced strategic implementation.

Summary: How to Define Profitable Catchment Areas Using Data Science Instead of Gut Feeling

- Why High Population Density Does Not Guarantee High Transaction Volume?

- How to Use Mobile Location Data to Draw Realistic Drive-Time Zones

- Fixed Radius or Isochronous Map: Which Method Prevents Failed Locations?

- The Cannibalization Error That Erodes 15% of Revenue in Adjacent Territories

- Splitting Large Territories: When to Slice a Zone to Boost Total Market Share

- How to Carve Exclusive Zones That Incentivize Investment Without Stifling Network Growth

- How to Identify Market Saturation Signals Before Opening Your Next Unit

- How to Use Mobile Location Data to Draw Realistic Drive-Time Zones

Why High Population Density Does Not Guarantee High Transaction Volume?

The most persistent myth in site selection is that high population density directly translates to high revenue. This assumption is a dangerous oversimplification. While a large population provides a potential customer base, it says nothing about their purchasing power, local competition, or shopping behavior. A densely populated area saturated with competitors and populated by residents whose income is allocated elsewhere can be a retail desert. Conversely, a less dense area with high disposable income and favorable access can be a goldmine.

The data consistently refutes the “density equals dollars” fallacy. For instance, detailed market analysis reveals that Oklahoma City ranks 9th in retail sales per capita among US metros, despite its relatively low population density. It achieves this through a combination of factors including a favorable retail mix, consumer spending habits, and lower competitive saturation. In stark contrast, Manhattan, one of the most densely populated places on the planet, has a surprisingly low retail-per-capita figure and has seen its retail vacancy rates climb steadily.

The case of Manhattan is particularly instructive. Despite a prosperous economy and high tourism, its retail vacancy and availability rates have climbed from 3.4% and 5.1% in late 2018 to 5.1% and 6.5% as of mid-2024. This is influenced by a post-COVID population decline and the inability of high-rent brick-and-mortar stores to compete with online pricing. This demonstrates that density is a vanity metric; the crucial variable is Territorial Yield—the actual revenue a specific location can extract from its environment. Calculating this requires moving beyond census data to analyze economic gravity and consumer behavior.

Ultimately, a successful catchment area is not defined by the number of people within it, but by the value of the transactions it can capture. Focusing on density alone ignores the fundamental economic forces that actually drive profitability.

How to Use Mobile Location Data to Draw Realistic Drive-Time Zones

If a fixed radius is inaccurate, the logical next step for many analysts is the drive-time zone, or isochrone. An isochrone map defines a catchment area based on how far one can travel from a specific point in a given amount of time (e.g., a 15-minute drive). This is a significant improvement as it accounts for the road network and average travel speeds. However, traditional isochrones are still theoretical models. They don’t reflect how people *actually* travel, which can be affected by real-time traffic, time of day, and individual willingness to travel.

This is where mobility intelligence, derived from anonymized mobile location data, becomes a game-changer. Instead of modeling a theoretical 15-minute drive, you can analyze the actual origin points of visitors to a comparable location or a competitor’s site. This data reveals the true shape and scale of a trade area. You may discover that your “15-minute” zone is actually a 10-minute zone during rush hour, or that you draw customers from a specific residential area 25 minutes away because of a convenient highway exit.

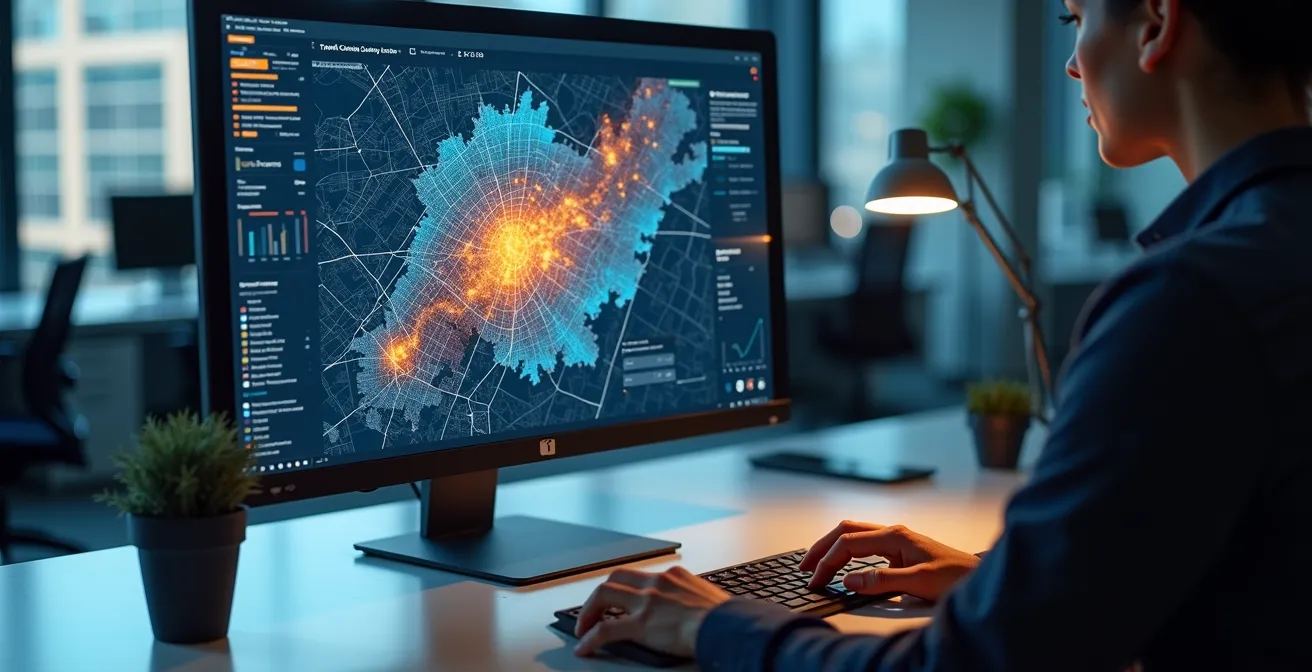

This granular, behavior-based approach allows for the creation of highly realistic and defensible catchment area polygons. These are not smooth, concentric rings but complex, irregular shapes that reflect the true gravitational pull of a location, as shown below.

By layering this real-world visitation data over a map, you can create data-driven isochronous contours. These contours show the percentage of your customer base that comes from within the 5-minute, 10-minute, and 15-minute drive-time zones. This allows you to identify not just the geographic extent of your reach, but also the core, primary, and secondary zones of your catchment area, each with a different level of customer penetration and marketing priority.

This shift from theoretical modeling to behavioral analysis is the first step in moving from gut-feeling site selection to a true data science-driven strategy.

Fixed Radius or Isochronous Map: Which Method Prevents Failed Locations?

The choice of methodology for defining a catchment area is not a minor technical detail; it is a critical strategic decision that directly impacts the success or failure of a location. The two most common methods—fixed radius and isochrone (drive/walk time)—operate on fundamentally different assumptions and yield dramatically different levels of accuracy. Understanding their respective strengths and weaknesses is essential for any development manager aiming to minimize risk.

A fixed-radius analysis is simple and fast, making it suitable for very high-level market screening. However, its core flaw is that it is geographically ignorant. It draws a perfect circle that presumes uniform accessibility in all directions, completely ignoring physical barriers like rivers, mountains, highways, or even large parks. This often leads to a grossly overestimated market size. For instance, analysis shows that ignoring physical barriers can lead to a 50%+ reduction in the truly accessible market compared to what a radius analysis would suggest. This is a recipe for a failed location based on phantom customers.

Isochronous mapping provides a more realistic model by accounting for the actual road or pedestrian network. However, even this method has limitations if it relies solely on generic travel times. The most accurate approach, behavior-based analysis using mobility data, offers the highest fidelity but requires more complex data processing. The following table breaks down these methods.

This comparative overview, based on a framework for evaluating different methods of calculating catchment areas, clarifies the trade-offs.

| Method | Best Use Case | Accuracy Level | Key Limitation |

|---|---|---|---|

| Fixed Radius | Quick market screening | Low | Ignores physical barriers |

| Drive/Walk Time (Isochrone) | Delivery zones, operational logistics | Medium | Doesn’t account for actual behavior |

| Behavior-Based (Mobility Data) | High-stakes site selection | High | Requires extensive data collection |

While a behavior-based model is the gold standard for high-stakes decisions, a well-executed isochrone analysis is the minimum viable method for preventing catastrophic errors. Relying on a fixed radius in anything but the most preliminary screening stage is an unnecessary gamble. The cost of a failed location far outweighs the investment in a more accurate geospatial analysis. Preventing failure starts with choosing a model that reflects reality.

Ultimately, selecting the right analytical tool is the first line of defense against committing capital to a location doomed by its geography.

The Cannibalization Error That Erodes 15% of Revenue in Adjacent Territories

Defining a single catchment area in isolation is only half the battle. In any network expansion strategy, the most insidious risk is sales cannibalization: the phenomenon where a new location’s sales come at the expense of existing, nearby locations. An aggressive growth plan that ignores this effect can lead to a network of underperforming units, frustrated franchisees, and a decline in overall portfolio profitability, even as the total number of stores increases. It creates the illusion of growth while eroding the value of established assets.

Cannibalization is not an all-or-nothing event; a small degree of overlap is often acceptable and inevitable. The critical task is to quantify it and establish a clear threshold. When does healthy competition turn into destructive cannibalization? While the exact number varies by industry, industry analysis indicates that a 20% cannibalization rate is often considered a critical threshold. Above this level, the new location is no longer generating truly incremental revenue for the network; it is simply stealing customers from its sister stores. The goal is not to eliminate overlap, but to manage it so that the new location adds more to the total network revenue than it takes away from others.

This effect is powerfully illustrated by the merging of territories, where distinct customer pools begin to bleed into one another, reducing the net gain for the entire system.

A stark example of this dynamic, albeit between channels, was seen with Target. When the company invested heavily in its digital sales, it saw online growth of over 30%. However, this was accompanied by a comparable store sales decline of over 3%, leading one analyst to call it a “total cannibalization of itself.” This illustrates the core principle: growth in one area that comes at the direct expense of another is not true growth. A proper geospatial strategy must use mobility data to model the potential customer flow between proposed and existing sites to forecast the net revenue impact on the entire network, not just the gross revenue of the new unit.

Ignoring this analysis is akin to funding your expansion by taking an undeclared, high-interest loan from your own most successful locations.

Splitting Large Territories: When to Slice a Zone to Boost Total Market Share

A common problem in a mature network is the “lazy” territory: a large, exclusive zone that was established years ago and is now underperforming. The franchisee or manager may be hitting their targets, but the territory itself has a much higher potential. Pockets of the zone may be completely unserved, or competitor density may have increased in one sub-region, drawing away potential customers. In these cases, leaving the territory as is means leaving money on the table. The strategic move is not just to defend a territory, but to optimize its yield, which often means splitting it.

Territory splitting, or “slicing,” is the process of carving a new, smaller territory out of a larger existing one. This allows for more focused operational and marketing efforts, deeper penetration into a specific sub-market, and can ultimately lead to a higher total market share for the network as a whole. The original territory might see a slight dip in revenue, but the combined revenue of the two new, smaller territories is significantly greater than what the single large territory was producing. This is a classic case of 1 + 1 = 3.

The decision to split a territory should not be based on intuition. It must be driven by data signals that indicate diminishing returns or untapped potential. Monitoring key performance indicators within a geospatial context can provide the clear, objective triggers needed to justify a split. This prevents disputes with existing stakeholders and ensures the decision is based on a sound business case for increasing overall network value.

Action Plan: Data-Driven Triggers for Territory Splitting

- Monitor if customer acquisition cost (CAC) rises for two consecutive quarters in the territory, signaling market saturation.

- Use mobility data to identify ‘cold spots’—areas with low customer penetration but high demographic potential—within the larger zone.

- Track when competitor density in a specific sub-zone reaches a critical threshold, indicating a need for a dedicated local presence.

- Analyze marketing campaign data to see if efforts yield progressively smaller gains in market share, suggesting the territory has reached its natural limit.

- Evaluate operational efficiency metrics (e.g., delivery times, travel for service calls) that show diminishing returns due to the territory’s large geographic spread.

By implementing a system to track these triggers, development managers can proactively identify opportunities to optimize their network footprint. It transforms territory management from a static, defensive posture to a dynamic, offensive strategy focused on maximizing total market share.

The goal is to ensure every square mile of your network is working at its full potential, rather than allowing large, inefficient territories to drag down overall performance.

How to Carve Exclusive Zones That Incentivize Investment Without Stifling Network Growth

For franchise-based businesses or networks with exclusive sales territories, defining these zones is a delicate balancing act. The territory must be large and valuable enough to incentivize a franchisee or partner to invest capital and effort. It must provide them with a clear, defensible opportunity for success. However, if the territories are too large or the exclusivity terms too rigid, it can stifle the overall growth of the network, creating unserved “white space” between zones and preventing the brand from achieving critical market density.

The solution is to move away from static, permanently-defined territories and toward a dynamic, performance-based model. This approach defines a territory not just by its geographic boundaries, but also by a set of performance covenants. For example, a franchisee might be granted an exclusive zone with the condition that they achieve a certain market penetration or revenue target within a specified timeframe. If these targets are not met, the franchisor retains the right to split the territory or place another location within it.

Case Study: Dynamic Performance-Based Territory Management

Companies like One World Commercial utilize comprehensive market analysis to ensure expansion strategies are data-driven. This approach allows for the creation of performance covenants, where territory rights are tied to achieving specific market penetration targets within defined timeframes. This ensures that the franchisee is incentivized to fully develop their market, while the network retains the flexibility to ensure full market coverage if performance lags. It aligns the interests of both the individual investor and the overall brand.

This dynamic model protects the network from underperforming partners who “sit” on valuable territory. It also requires a sophisticated understanding of the market’s real potential to set fair and achievable targets. Economic uncertainty can impact performance, and the system must be flexible enough to account for external factors beyond the franchisee’s control. As one industry executive noted in a Franchise Times analysis, external pressures can slow decision-making and impact activity.

In markets where consumer confidence is low, our franchisees may see a slowdown in buyer activity due to uncertainty. Our franchisees continue to make appointments at a historically high percent, and that’s a positive, but we’re also seeing many sellers being slower to make decisions given their own uncertainty.

– Industry Executive, Franchise Times – Real Estate Market Analysis

Therefore, a successful exclusive territory strategy combines a data-driven definition of the zone’s potential with a flexible, performance-based legal framework. This incentivizes investment while ensuring the network’s long-term health and ability to adapt to changing market conditions.

It’s about creating a partnership where the success of the individual franchisee is directly tied to the complete and effective saturation of the market by the brand.

How to Identify Market Saturation Signals Before Opening Your Next Unit

One of the costliest errors in network expansion is entering a market that is already saturated. At the point of saturation, the supply of a particular type of good or service has met or exceeded demand. A new entrant at this stage faces a brutal battle for a shrinking pool of available customer dollars. Customer acquisition costs skyrocket, marketing efforts yield minimal returns, and the path to profitability becomes incredibly steep. The key is to identify these saturation signals *before* committing to a lease or purchase, not after.

Market saturation is not always obvious from a simple competitor mapping exercise. A market can feel “full” long before every street corner has a competitor. The signals are often more subtle and appear as leading economic indicators rather than lagging physical ones. By monitoring these digital and real estate trends, a development manager can get an early warning that a market is approaching its tipping point. This requires a shift in focus from counting existing storefronts to measuring the underlying competitive pressure.

For example, a sharp and sustained increase in the Cost-Per-Click (CPC) for category keywords on platforms like Google Ads is a classic leading indicator. It means more competitors are bidding for the same audience, driving up the cost of attention. Similarly, rising ad impression costs on social media platforms for your target demographic can signal audience fatigue or oversaturation. These are clear signs that the low-hanging fruit has been picked. The most savvy developers monitor a dashboard of these indicators to create a “saturation score” for any potential market.

Here are some of the most reliable early warning indicators of market saturation:

- Rising Digital Ad Costs: Track Google Ads CPC for your primary service or product keywords. Sharp, sustained increases signal that more competitors are bidding aggressively for the same customer intent.

- Shrinking Property Inventory: Monitor the availability of suitable commercial properties in your target size and class. A rapidly shrinking inventory and rising lease rates indicate that other businesses are also expanding into the area.

- Lengthening ‘Days on Market’: Conversely, for the commercial real estate market as a whole, an increase in the average ‘days on market’ can signal economic cooling or that the market is overbuilt.

- Disposable Income Allocation: Analyze economic data to determine if the target audience in a specific geography is already allocating the maximum plausible share of their disposable income to your product category.

This data-driven vigilance allows you to avoid costly battles of attrition and instead focus your resources on markets with genuine, untapped growth potential.

Key takeaways

- Gut-feeling and simple radius analysis are unreliable and lead to costly site selection errors.

- True territory potential is revealed by modeling human behavior with mobility data, not by counting population.

- A data-science approach involves defining realistic isochronous zones, quantifying cannibalization risk, and identifying market saturation signals before investment.

How to Use Mobile Location Data to Draw Realistic Drive-Time Zones

While creating isochronous zones based on mobile data provides a powerful model of a catchment area’s *potential* reach, the analysis should not stop there. The next, more advanced step is to use a different facet of mobility intelligence—footfall data—to validate and refine these theoretical polygons. Footfall analysis involves measuring the volume and origin of actual visitors to a specific point of interest (POI), whether it’s your own existing store, a competitor’s location, or a complementary business.

This validation process answers a crucial question: does the observed reality match the theoretical model? For example, your isochrone model might show a strong potential to draw customers from a residential neighborhood to the west. However, footfall data from a nearby competitor might reveal that, in reality, very few people from that neighborhood actually cross the highway to shop on your side of town. This discrepancy between the model and observed behavior is a critical insight, highlighting an unforeseen barrier or a flaw in the initial assumption of the gravitational model. It allows you to adjust the boundaries of your catchment area based on proven, real-world travel patterns.

Furthermore, footfall data allows you to move beyond static zones and map actual customer journeys. By analyzing the paths people take before and after visiting a location, you can understand crucial behavioral patterns. Do customers visit you as part of a larger shopping trip? Do they come directly from home or from work? Which other brands or locations are part of their typical journey? This level of insight is invaluable for refining marketing strategies, identifying cross-promotional opportunities, and understanding the true role your location plays in the daily life of your customers.

Ultimately, combining predictive isochrone modeling with observational footfall analysis creates a robust, multi-layered view of your catchment area. It replaces assumption with evidence, ensuring that your strategic decisions are grounded not just in what is possible, but in what is actually happening on the ground.