For a franchisee, the lease vs. buy decision is a strategic asset lifecycle exercise, not just a financial one.

- The best choice minimizes the Total Cost of Ownership (TCO) over the equipment’s life, not just the initial price.

- Franchise rules, like approved vendors and mandatory upgrades, are the most significant factor in your decision framework.

Recommendation: Prioritize leasing for equipment with high obsolescence or mandated refresh cycles to preserve capital for operations and maintain compliance.

As a new franchisee, you’re facing one of your first major financial hurdles: acquiring $100,000 worth of essential equipment. Whether it’s a suite of commercial ovens or a fleet of high-performance treadmills, the pressure is immense. The conventional wisdom offers a simple binary choice: buy for long-term equity or lease to preserve upfront cash. This advice, while not wrong, is dangerously incomplete for someone in your position.

The standard “lease vs. buy” debate often overlooks the unique constraints and opportunities of a franchise system. You aren’t an independent operator. Your decisions are guided by a franchise agreement, brand standards, and a non-negotiable operational playbook. Simply looking at the sticker price or the monthly payment is a critical error. It ignores the hidden factors that truly impact your profitability: maintenance, downtime, mandatory upgrades, and asset disposal.

This guide reframes the decision not as a simple financial transaction, but as your first major act as a strategic asset manager. The real question isn’t just “How do I pay for this?” but rather, “What is the most intelligent way to manage this asset’s entire lifecycle within my franchise’s ecosystem?” We will move beyond the surface-level cash flow argument to explore a framework that accounts for total cost, compliance, and long-term value preservation, ensuring your capital works for you, not against you.

To navigate this complex decision, this article breaks down the key strategic pillars you must consider as a franchisee. The following sections provide a complete lifecycle framework, from initial acquisition risks to end-of-life value recovery.

Summary: Lease vs. Buy: A Franchisee’s Strategic Decision Framework

- Why Buying Second-Hand Equipment Can Cost You Double in Repairs and Downtime?

- The Preventive Maintenance Schedule That Extends Asset Life by 3 Years

- Planning for Upgrades: Budgeting for the Mandatory POS Refresh in Year 5

- The “Approved Vendor” Rule: Why You Can’t Just Buy a Fridge from Home Depot?

- Selling Old Assets: How to Recover Value When Upgrading Equipment

- Who Pays for the Pivot? Structuring Incentives for Mandated Equipment Upgrades

- Beyond Banks: When to Use Equipment Leasing to Preserve Cash for Operations

- How to Deploy Standardized Management Systems Across 50 Locations Without Chaos

Why Buying Second-Hand Equipment Can Cost You Double in Repairs and Downtime?

The temptation to cut initial capital expenditure by purchasing used equipment is strong, especially when facing a six-figure bill. However, this seemingly savvy move often backfires spectacularly. The initial savings are frequently consumed by a higher Total Cost of Ownership (TCO). TCO extends far beyond the purchase price; it includes every cost associated with an asset over its useful life. For a franchisee, where operational uptime is paramount, the hidden costs of used equipment—unexpected repairs, lower efficiency, and critical downtime—can cripple a new business before it even finds its footing.

The core issue is that the sticker price is only a fraction of the lifecycle cost. In fact, research by Gartner shows that 80% of TCO often comes from post-purchase expenses like technical support, maintenance, and labor. A new, warrantied piece of equipment from an approved vendor comes with predictable, manageable operational costs. A second-hand machine, by contrast, is a black box of potential liabilities. A single day of downtime on a critical piece of equipment like a point-of-sale (POS) system or a primary oven can result in revenue loss that far exceeds the initial savings on the purchase.

This is where the asset manager mindset is critical. Instead of asking “What’s the cheapest way to get this?”, you must ask “What is the most reliable and cost-predictable way to deliver the function this asset provides?”. The answer almost always favors new equipment that aligns with the franchisor’s standards, as it insulates you from the unpredictable and often crippling costs of aftermarket failures. The initial higher outlay is a premium paid for operational stability and predictable budgeting.

The Preventive Maintenance Schedule That Extends Asset Life by 3 Years

Once you’ve acquired your equipment, the focus immediately shifts from acquisition to preservation. An asset’s lifespan is not a fixed number; it is directly influenced by your maintenance strategy. A reactive “fix-it-when-it-breaks” approach is a recipe for budget overruns and operational chaos. A strategic asset manager implements a preventive maintenance (PM) schedule from day one. This involves regular, planned service—cleaning, calibration, and component replacement—to prevent failures before they occur. This proactive stance not only extends the functional life of your equipment but also ensures it operates at peak efficiency, reducing energy consumption and waste.

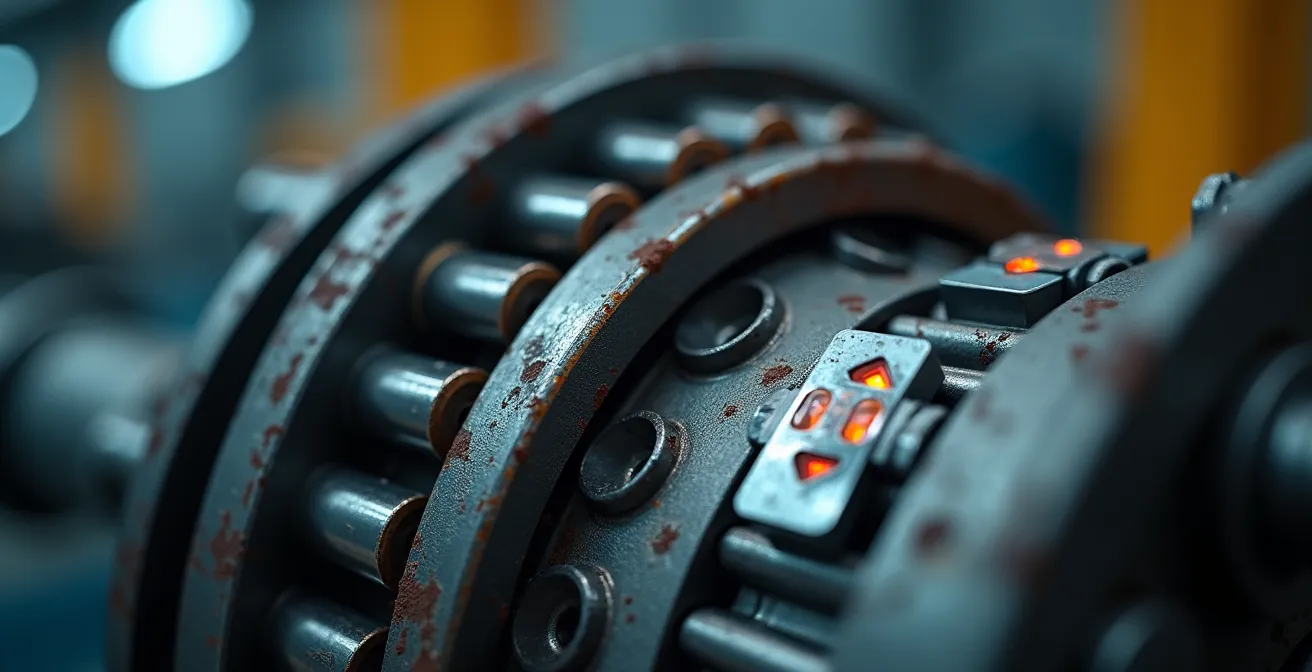

The next evolution of this strategy is predictive maintenance, which leverages IoT (Internet of Things) sensors to monitor equipment in real-time. This allows you to service assets based on actual condition rather than a fixed schedule. The ROI on this approach is compelling. An IoT Analytics research report found that 95% of adopters reported a positive return on their investment through reduced downtime and maintenance costs. For a franchisee, this means fewer emergency calls to technicians and more predictable operational uptime.

This image illustrates how non-invasive sensors can be attached to critical machinery. They track metrics like vibration, temperature, and power consumption, feeding data to a system that can flag anomalies indicative of an impending failure. By shifting from a scheduled or reactive model to a data-driven one, you transform maintenance from an unpredictable expense into a strategic tool for maximizing asset value and ensuring your location runs smoothly, meeting the high standards expected by your customers and your franchisor.

Planning for Upgrades: Budgeting for the Mandatory POS Refresh in Year 5

In a franchise system, equipment doesn’t last forever by choice. The franchise agreement often dictates a mandatory refresh cycle for critical technology, such as the Point-of-Sale (POS) system, typically every five years. This isn’t a suggestion; it’s a contractual obligation to maintain brand consistency, security, and a modern customer experience. Failing to plan for this significant capital expenditure can put a franchisee in a severe cash crunch. A strategic asset manager anticipates this event from the day they open their doors.

The most effective method for this is establishing a Capital Expenditure (CapEx) sinking fund. This is a dedicated savings account where you systematically set aside funds each month specifically for future equipment upgrades. For a $15,000 POS system refresh in 60 months, this means allocating $250 per month. This simple discipline transforms a future crisis into a manageable, predictable operating expense. It ensures that when the upgrade mandate arrives, you have the capital ready without needing to seek emergency financing or drain your operational cash reserves.

Case Study: Leasing to Manage Large Upfront Costs

Consider a manufacturing startup that needed $250,000 worth of CNC machines. Instead of depleting their working capital with a purchase, they chose to lease the equipment. This allowed them to acquire the necessary assets with manageable monthly payments of approximately $4,200, preserving precious cash for hiring, marketing, and operations. For a franchisee facing a similar large equipment outlay, this strategy provides a clear path to getting operational without compromising financial stability.

Furthermore, this foresight allows for better negotiation. By planning ahead, you can often work with your franchisor or an equipment financing company to structure a Master Lease Agreement that includes a technology refresh clause, locking in terms and costs years in advance. This proactive financial planning is a hallmark of a successful, multi-unit franchisee who thinks in lifecycles, not just immediate costs.

Your Action Plan: The Franchise Equipment Acquisition Checklist

- Points of Contact: Systematically review your franchise agreement to list all equipment-related mandates, including approved vendors, required models, and mandatory upgrade schedules.

- Collect: Inventory all approved acquisition options provided by the franchisor for each piece of equipment (e.g., preferred leasing partners, outright purchase specifications).

- Coherence: Develop a Total Cost of Ownership (TCO) model for each option, confronting the lifecycle costs against your five-year business plan and cash flow projections.

- Memorability/Emotion: Evaluate the strategic flexibility of each choice. Which option best protects your business from technological obsolescence versus which option builds long-term balance sheet equity?

- Plan for Integration: Once a path is chosen, build the financing or leasing application process directly into your pre-opening project timeline to avoid delays.

The “Approved Vendor” Rule: Why You Can’t Just Buy a Fridge from Home Depot?

One of the first realities a new franchisee confronts is the Approved Vendor List (AVL). You can’t simply go to a big-box retailer and buy a commercial refrigerator, even if it looks identical and costs less. The franchisor mandates specific makes and models from a select list of suppliers. This rule isn’t arbitrary; it’s the bedrock of brand consistency and operational uniformity. Every location must deliver the same customer experience, which requires standardized equipment that performs predictably, is serviced consistently, and meets specific design aesthetics.

While this may seem restrictive, the AVL provides hidden benefits. It guarantees a certain level of quality, ensures that spare parts are readily available across the system, and simplifies maintenance training. More importantly, it provides a powerful argument for leasing. When you’re required to use specific, often expensive, equipment that may be subject to a future refresh, tying up capital in an asset you don’t fully control can be a poor strategic choice. Leasing passes the risk of obsolescence to the leasing company, allowing you to stay compliant with brand standards without sacrificing your financial flexibility.

The standardized environment, as seen in this compliant commercial kitchen, is the franchise’s core value proposition. Every element is designed for efficiency, safety, and brand replication. Straying from the AVL to save a few dollars introduces a non-standard variable that can compromise food quality, service speed, or even violate local health codes that the approved equipment is certified for. Embracing the AVL and using leasing as a tool to comply with it is often the most intelligent path for a new franchisee.

Selling Old Assets: How to Recover Value When Upgrading Equipment

The final stage of the asset lifecycle—disposal—is often an afterthought, but it holds significant potential for value recovery. When it’s time to upgrade a kitchen full of equipment or refresh your gym’s cardio machines, simply scrapping the old assets is like throwing money away. A strategic asset manager has a clear disposition strategy to maximize the residual value of outgoing equipment. This recovered capital can then be used to offset the cost of the new assets, effectively lowering the net cost of the upgrade.

There are several channels for asset disposition, each with its own trade-offs between recovery rate and effort. The optimal choice depends on the equipment’s condition, the urgency of the replacement, and the structure of your franchise network. For instance, selling to another franchisee within the same system is often a high-value option, as the equipment is already brand-approved. Online auctions can reach a wider market for specialized gear, while a trade-in with the new equipment vendor offers speed and convenience, albeit at a lower recovery rate.

The following table outlines the most common asset disposal methods and their typical outcomes, providing a clear framework for making a strategic choice.

| Disposal Method | Typical Recovery Rate | Time to Execute | Best For |

|---|---|---|---|

| Internal Redeployment | 100% value retention | 1-2 weeks | Multi-location businesses |

| Sale to Other Franchisee | 70-80% of book value | 2-4 weeks | Franchise networks |

| Online Auction | 50-70% of book value | 3-6 weeks | Specialized equipment |

| Trade-in with Vendor | 40-60% of book value | Immediate | Quick turnover needs |

| Scrap/Recycling | 5-15% of original cost | 1 week | End-of-life equipment |

Another advanced strategy is a sale-leaseback transaction. This involves selling equipment you already own to a leasing company and then leasing it back from them. This can be a powerful tool to inject a significant amount of cash back into your business, turning fixed assets on your balance sheet into liquid working capital for expansion, marketing, or operational needs.

Who Pays for the Pivot? Structuring Incentives for Mandated Equipment Upgrades

A mandated system-wide upgrade can feel like a top-down financial burden for a franchisee. However, it can also be an opportunity for a collaborative partnership with the franchisor. The most successful franchise systems structure these pivots not as decrees, but as shared-risk, shared-reward initiatives. The central question—”Who pays?”—is best answered with “How can we both benefit?”. A smart franchisee, sometimes in concert with others, can negotiate for incentive structures that cushion the financial blow and align both parties toward a common goal of increased revenue and efficiency.

Effective incentive models often involve some form of franchisor co-investment tied to performance. For example, the franchisor might subsidize a portion of the equipment lease for the first year, with the franchisee’s share increasing as the new equipment proves its ROI through higher sales or lower operating costs. Another common strategy is the creation of performance bonuses for early adopters, rewarding the first 10% of locations to complete the upgrade. This creates momentum and provides valuable case studies for the rest of the system.

The franchisor can also leverage its scale to provide significant value beyond direct financial contributions. This includes negotiating a master lease agreement with a financing company that offers preferential rates and terms available only to its franchisees. Additionally, providing comprehensive, on-site training for the new equipment is a powerful form of non-cash support that reduces the franchisee’s implementation costs and accelerates the time-to-value. The key is to approach the negotiation not as an adversary, but as a partner seeking a mutually beneficial outcome from a necessary technological or strategic pivot.

Beyond Banks: When to Use Equipment Leasing to Preserve Cash for Operations

For a new franchisee, cash is king. Every dollar of initial capital is precious and must be allocated to high-impact areas like marketing, inventory, and payroll. Tying up a significant portion of that capital in equipment that will depreciate can be a strategic error. This is where equipment leasing moves from a simple financing option to a cornerstone of your cash flow preservation strategy. Unlike a traditional bank loan that requires a substantial down payment (typically 10-20%), a lease often requires little to no money down, freeing up your capital for the operational needs of a growing business.

Equipment lessors and vendor financing programs operate differently from banks. They specialize in asset-based lending, where the equipment itself serves as the collateral. This often results in faster approvals (sometimes within 24-48 hours), more flexible terms, and less impact on your existing business credit lines. As Bethany K. Laurence of Nolo points out, the trade-off is clear:

Leasing equipment preserves cash and offers upgrade flexibility, but typically costs more overall and doesn’t build ownership equity. Buying equipment gives you valuable ownership and tax breaks, but requires more upfront cash and risks getting stuck with outdated assets.

– Bethany K. Laurence, Nolo Business Equipment Guide

The decision hinges on your strategic priorities. If your primary goal is to get your doors open with maximum financial agility and protect yourself from mandated upgrades and technological obsolescence, leasing is an incredibly powerful tool. It keeps your balance sheet lean and your cash reserves ready for the opportunities and challenges of your first years in business.

This decision matrix provides a clear overview of the key differences between your primary financing sources.

| Criteria | Traditional Bank Loan | Equipment Lessor | Vendor/Captive Financing |

|---|---|---|---|

| Speed of Approval | 2-4 weeks | 24-48 hours | Same day possible |

| Down Payment Required | 10-20% | 0-5% | 0-10% |

| Collateral Requirements | Business assets + personal guarantee | Equipment only | Equipment only |

| Impact on Credit Lines | Reduces borrowing capacity | Off-balance sheet option | Minimal impact |

| End-of-Life Flexibility | Own equipment, disposal responsibility | Return, upgrade, or purchase options | Varies by program |

Key Takeaways

- Franchise Compliance is Paramount: Your equipment decisions are dictated by the franchisor’s rules on approved vendors and mandatory upgrades, making leasing a powerful compliance tool.

- Focus on Total Cost of Ownership (TCO): The cheapest initial price is rarely the most profitable long-term solution. Factor in maintenance, downtime, and disposal value.

- Preserve Capital for Growth: Leasing frees up critical cash for operations, marketing, and unforeseen challenges, giving your new business the agility it needs to succeed.

How to Deploy Standardized Management Systems Across 50 Locations Without Chaos

As a franchisee’s portfolio grows from one location to five, fifty, or more, the principles of asset management don’t change, but the complexity of execution explodes. The key to scaling successfully without inducing chaos is the deployment of standardized management systems. A documented, repeatable process for everything—from equipment procurement and maintenance scheduling to employee training and performance tracking—is the only way to ensure consistency and quality across a distributed network.

The rollout of any new system should begin with a controlled pilot program. Select 1-3 diverse locations to test the new process or technology. This beta phase is invaluable for identifying bugs, refining checklists, and creating “champion” users who will become advocates for the change. The lessons learned in a controlled environment allow you to create a proven playbook before attempting a full-scale rollout, dramatically reducing risk and increasing the probability of success. The benefits of such standardized, technology-enabled systems are significant; for example, manufacturers implementing IoT systems for maintenance achieve a 25% reduction in costs and a 30% improvement in equipment uptime.

This systematic approach is the ultimate expression of the asset manager mindset. It treats the entire portfolio of locations as a single, cohesive system. By creating a scalable framework for managing physical assets, technology, and human processes, a multi-unit operator can achieve efficiencies and a level of consistency that a collection of independent-minded locations never could. This strategic discipline is what separates a franchisee who simply runs a few stores from one who builds a true enterprise.

By adopting this strategic, lifecycle-focused approach to equipment decisions, you position your new franchise for long-term financial health and operational excellence. Now is the time to apply this framework to your own business plan and build an asset strategy that supports, rather than hinders, your growth.